work opportunity tax credit questionnaire reddit

A work opportunity tax credit questionnaire helps to find out whether a company is following the Work Opportunity tax credit program as directed by the Federal government. The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from.

Wotc Form 8850 Hiring Without Fear Of Discrimination Emptech Blog

How much of the WOTC youll be eligible to receive when you hire an individual from a target group may vary but the typical amount of tax credit you can receive is between 25 to 40 of the employees wages in the first year of their employment.

. There are two sets of frequently asked questions for WOTC customers. It asks for your SSN and if you are under 40. In the case of the above.

In the case of the above question the sender did not provide their email address so we were unable to reply directly to them. By creating economic opportunities this program also helps lessen the burden on other government assistance programs. Work Opportunity Tax Credit WOTC Frequently Asked Questions.

Questions and answers about the Work Opportunity Tax Credit program. Below you will find the steps to complete the WOTC both ways. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website.

WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc. WOTC is a federal tax credit program available to employers who hire and retain veterans and individuals from other target groups that may have challenges to securing employment. Employers must apply for and receive a certification verifying the new hire is a.

At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website from a new hire. What Is the WOTC Program. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group.

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction. It also says that the employer is encouraged to hire individuals who are facing barriers to employment.

Employers generally can earn a tax credit equal to 25 or 40 of a new employees first-year wages up to the maximum for the target group to which the employee belongs. Completing Your WOTC Questionnaire. Use the WOTC Calculator to see how much your business can earn in tax credits.

The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers in securing employment. This is a frequently asked question that we receive from both employers and their new hires. This questionnaire will not.

Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. WOTC is not only intended to incentivize employers but provides considerable benefits to your community.

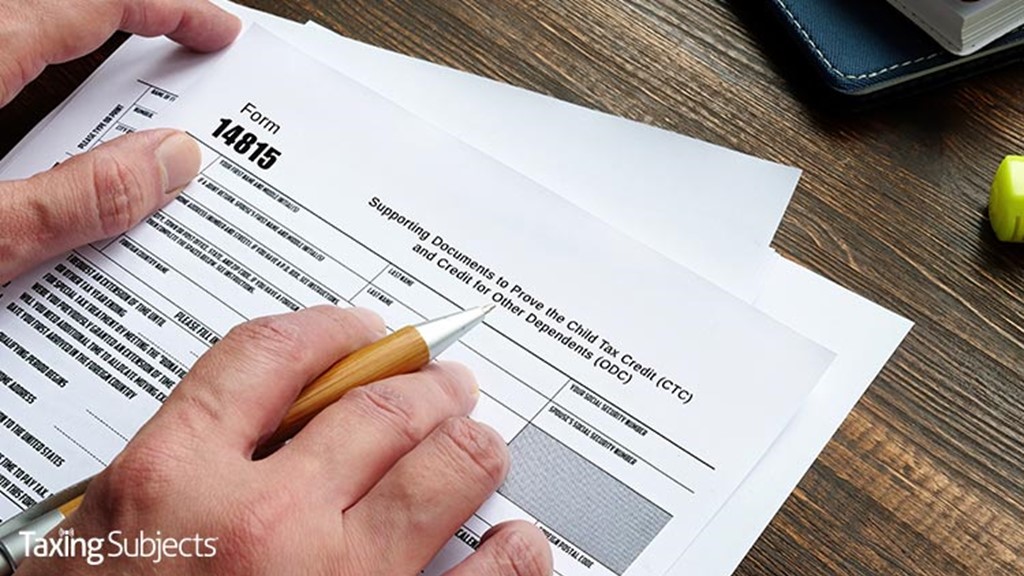

Since 1996 the federal government has used the Work Opportunity Tax Credit program to reduce the federal tax liability of employers who hire individuals from groups that often face significant barriers to employment. As part of the application process we ask that you complete a short questionnaire in order to assess eligibility for the Work Opportunity Tax Credit Program WOTC. IRS Form 8850 Instructions Instructions for completing.

Employers will earn 25 if the employee works at least 120 hours and 40 if the employee works at least 400 hours. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program. The answers are not supposed to give preference to applicants.

Eeoc Issues Formal Opinion On The Work Opportunity Tax Credit Cost Management Services Work Opportunity Tax Credits Experts

Irs Highlights Info About The Credit For Other Dependents Taxing Subjects

Earned Income Tax Credit Eitc Interactive And Resources

Wotc By The Numbers Wotc Certifications Issued By Target Group 2008 2012 Cost Management Services Work Opportunity Tax Credits Experts

Wotc Questions How Much Do You Get With Each Category Cost Management Services Work Opportunity Tax Credits Experts

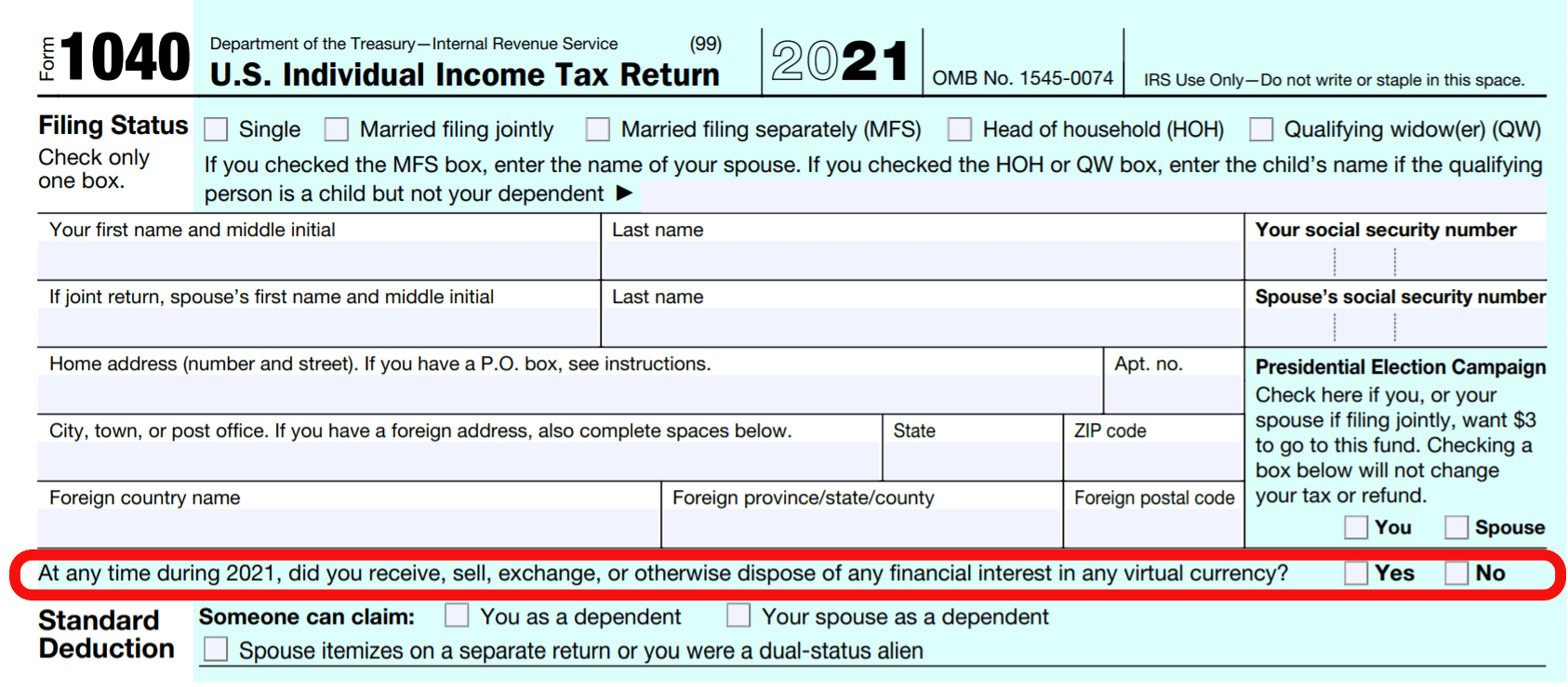

The Irs Wants To Know About Your Crypto Transactions This Tax Season

Work Opportunity Tax Credit What Is Wotc Adp

Wotc In The News Reintroduction Of The Military Spouse Hiring Act Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit What Is Wotc Adp

Tax Credit Services Company Tax Credit Co

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

American Opportunity Tax Credit H R Block

Insert A Form Into A Pop Up Modal With Ctools And Drupal 7 Deeson Online Drupal Pinterest Drupal Labs And Pop

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

How To Get Tax Credits For Hiring Veterans Military Com

Work Opportunity Tax Credit What Is Wotc Adp

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1144541711-111b0ab2182848498ec783fa6d5bbd35-b749d033009a41a2903348e46f7bde60.jpg)